Both the Blockchain and BOINC provide safeguards against node down. Including ASYNC databases and transactions. That’s what they do.

Bitcoin client would have to be rewritten as it doesn’t share rewards.

Also important is the sorting machinery. Only NSA and Vocus etc ( with milk creds ) have the real-time machinery to create sorting machines. Including quality etc.

They can create the loom too, for on demand $10/- Australian bamboo fiber anti allergenic T shirts. Orders placed online.

The biggest issue with the ASX is delivery. People just speculating and not taking the material on the 11th hour. They need double signed boxes to long term store commodities.

It’s a training issue for the common man to buy only > 1 year old stores and < 10 year old stores. Almost assuredly skip the entire supply chain horror that is fresh food.

They would also need to create a) automation and b) mobile phone sized general anaerobic respiration testing machine to see how the food is doing for every can.

Ego is not welcome, neither are paranoid mothers.

At the outset they would need to create the BTC/AUD, AUD/BTC, ETH/AUD, AUD/ETH, GRID/AUD, and AUD/GRID, RIPPLE/AUD, AUD/RIPPLE financial instruments only accepting five significant digits. They would have to be the market makers themselves in the architecture so that all these instruments are like the Forex variants, completely verifiable as random curves with max standard deviation as 1 per month.

They may choose to skip the faulty definition of randomness that has been used to steal 100 trillion dollars from Australia in the last 100 years.

All one needs to do is to create a purely random set of digits around the smooth normal curve. In which case standard deviation won’t apply, it’ll just be a dotted blob around the perfect 1/X curve. Area of blob and weight of blob being important so too the centre of gravity.

Again verifiable on the Blockchain, refer Pandom, and Meresine Twister 600 dimension random numbers.

And slowly withdraw their market making still pseudo random but actual orders till the real market takes it over verifiably, always filling it in if there’s a glitch. The architecture needs to be similarly hosted in ten nations, so too the material.

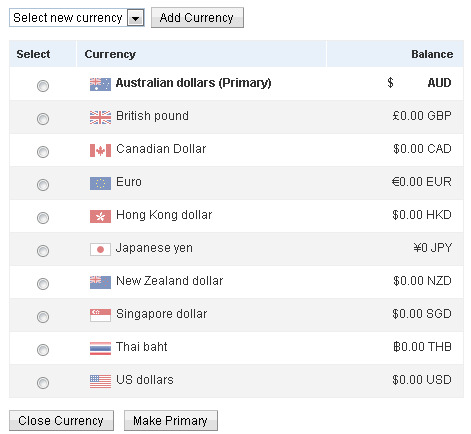

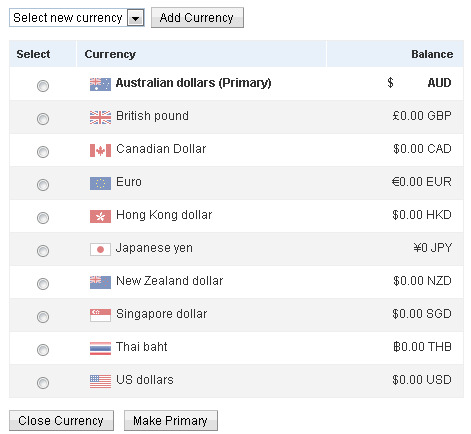

The ten nations chosen by the Australia Post cash passport are thus: