Partially, but probably also has a lot to do with housing prices relative to incomes building up over time.

Either way, there’s a cycle to these things. At some point, and probably not too far away, a down cycle is inevitable. The question is, what will our proposed Policy be in response to the wide range of jobs that will probably go away then, and not return?

Here is a video of Steve Keen explaining a debt jubilee: https://www.youtube.com/embed/3vZX8Zh4SBM?start=428&end=582&version=3

@Jesse_Hermans has previously advocated for a land tax which he can explain better than I can.

The “jobless recovery” from post-GFC was a failure of government policy to provide sufficient demand to keep the labour market buoyant, especially in the US and EU.

If you look through the labour market data, you’ll find Australia mostly avoided this and was recovering off the back of stimulus up until 2013 - when it intentionally was withdrawn for political reasons rather than economic reasons.

As pointed out in the Plan Jefes program, instead of waiting for growth to come first and then “trickle down” into more jobs, the program results in a jobs first recovery from the bottom up. In Argentina the unemployment rate fell before growth resumed, which shows that waiting for growth to lead to jobs recovery instead of driving recovery through job creation is political choice - a pretty stupid and inefficient one at that.

This is an extreme ideological position held by some in the BCA and generally libertarian right schools of economics e.g. Austrian. It not supported in the empirical data that recessions are “efficient” or a “good outcome”. The loss of productivity, output, slow recovery and general human misery vastly outweigh dubious “cleansing” processes.

This is an excellent point, and one we had Steve Keen mention at our Right2Work conference. We need to get buffer-stock program like this in place ASAP to prevent another harrowing event on the employability, skills and experience of the labour force when that recession hits. The transition from housing development will best be substituted with the massive infrastructure deficit we have in Australia, which governments are already starting to do. However they’re arbitrarily holding themselves back over misconceived concern about increasing debt and not having Land Value Capture mechanisms in place to make these projects self funding (at state and local level).

Jesse, I think we’re talking at cross purposes.

I’m not saying that recessions are a good thing, and I don’t think I’m extolling any kind of ideological stance on this, just making the observation that when recession happens, it filters out the least efficient individual businesses. I mean this in the really obvious sense, that if they were more efficient, they would beat the less efficient businesses and survive.

In most businesses today, efficiency largely depends on how well you leverage technology. Personally, I see this reality on the ground every day. Revenue per headcount is massively up compared to history. One person performs the function of many from even 10 years ago.

If your business is not doing this, they will be beaten by another business that does. Most likely, this will fallout during a recession, just because of increased financial stress. New businesses starting after a recession have to start at or above the new efficiency baseline.

I am missing something?

We already have land tax in our policies.

Something more focused on specifically fixing the housing issue with land tax and debt jubilee could be a good thing.

Housing is a hot topic.

Also, FYI @Jesse_Hermans, you don’t have to wait a whole year to introduce policy at next Congress. If we have important new policy to introduce, you can request that the NC call a specific Policy meeting, like a mini Congress without the people elections. It’s been done before and is specifically allowed in the Constitution.

@AndrewDowning Have you seen this? https://www.prosper.org.au/our-policy/

You don’t need a recession for “creative destruction” to operate and kill off less efficient competitors. That’s a natural feature inherent in capitalism. You do kill of marginal businesses quickly in recession but this is inefficient given you rapidly forced them out of business without waiting for alternative businesses and markets to steal market share and develop employment opportunities before they went out of business. The recovery process post recession is very slow and inefficient at allowing new start ups and replacement firms to develop and flourish, given sales demand is anaemic and unemployment/underemployment high. Banks are tight with credit and don’t punt on business expansion in such a poor environment.

The “pitstop” model of recession suggests that managers take time during recessions to streamline their processes.

Martin Baily (in commenting on the Blanchard and Diamond “cleaning up” idea) said that:

the data did not accord well with a “cleaning up” or”pitstop” model of recessions … productivity fell during a recession, contrary to what would be expected if managers were streamlining their production process.

At the time, this “pitstop” analogy was used, another economist (commenting on the same paper) said that the “lack of a spike up in employment after a recession hurts the pitstop metaphor since after a pitstop people get going right away.”

Further, George Perry (in the same commentary) argued that:

during recessions many people switch from long-duration jobs to temporary jobs, resulting in a greater proportion of the work force in short-duration jobs. If the amount of job creation and destruction is relatively constant in the temporary jobs, then the destruction is taking place in the long-duration jobs. This view provides a harsher picture of what happens during a recession than one would get if the change in job composition were ignored.

This is consistent with the view that recessions are deeply inefficient events not akin to a new birth.

cheers, good to know

Yep. Georgist economics is already popular here.

Dude, preaching and choirs.

I am not saying recessions are good.

I’m pointing out a practical reality, that has policy, timing and strategy implications for PPAU.

If a recession is likely to happen (we don’t have anything like the influence to change this), and higher than usual job fallout is likely at such times, then there is a timely opportunity for us to start looking like part of the solution.

On that note I’ve watched a new Bill Mitchell MMT presentation he made to a political party in NZ recently, as well as a radio interview on RadioNZ. Worth watching to get insight into how a JG would be “funded”:

@alexjago in the spirit of NABBB (not another big bloody bureaucracy) and totally out of left field, I am starting to think about how can we guarantee livelihoods for all (Universal Basic Income at XX% above poverty line) and remove all pensions and associated bureaucracies, and secondly of a Job Guarantee Rebate (enough to take UBI + JGR to the minimum wage ) to any organisations that offers permanent employment, either part time or full time, as a tax deduction. This way the jobs follow where the work is, organically. The unions may say, but that will turn us into a wage slave class! I would respond that employees become more valuable in a thriving economy, especially when they have skills that are in demand. I suspect the for profit, as well as not for profit find such an arrangement appealing. I also suspect that more worker co-operatives would emerge. It may even permit the craft class to survive and thrive. Will it put pressure on resources? Not sure…some modelling might help. But a model is only as good as the underpinning assumptions. My response to the inflation fear…clearly there is a large pool of under utilised people, so we are a long way from a ‘wage’ escalation. Material resources? Don’t have an answer there. Increased worker incomes may drive a noticeable demand in consumables - food, alcohol, etc - but that would be all. I suspect that a distributive UBI+JGR economy would increase the number of services and products that are based largely on labor input eg services (childminding, housecleaning, gardening, environmental work, nursing homes, social services etc) and craft, culture and art work.

Another thought bubble, my thoughts only…just as capitalism could be considered the shift of power from the elite royalty/peerage class to the business class, perhaps this shift from centrally concentrated systems to distributed systems could herald the shift of power from the capital class to citizens. Just some musings over coffee.

If JG were implemented as a rebate to private employers, then they would just treat that as a way to employ people to do work without the usual costs or employment regulations.

By contrast, JG as an independent directly funded government initiative acts similarly to a minimum wage in that workers would require better pay and/or opportunities than the JG to be offered by a potential employer, or else they would just stay on the JG.

Exactly, on point Andrew. We can’t subsidise private for profit firms under the program, otherwise technically speaking anyone can enter the JG and then walk into their job with the wage subsidy on top of their existing wage, which goes on across the entire economy. No modelling or design of Job Guarantees proposals advocate for this. In fact generally speaking the evidence is heavily stacked against the use of wage subsidies for private employment.

The reason not-for-profit service providers are potentially includable is they run on volunteers to provide what ineffect are public services the government has outsourced to the charitable sector. Simply acknowledging this work with pay for services render technically indirectly incorporates them into de facto public sector employment, but with the operations/management handeled by external third parties.

That said the details of how a NFP qualifies to receive these JG wage reimbursements is an important question. It might be something a citizen’s jury should evaluate. I’d have to read more into the details of JG policy designs to specify how NFP incorporation and reimbursement would function. There is a danger in running off with modifications and alternative designs that have not been rigerously developed and/or piloted, since we are then proposing something fundamentally different which could have unforeseen perverse outcomes.

Only the for-profit jobs decrease…plenty of not-for profit, and low profit work will abound, me thinks …a resilient community is a HIGH human touch community.

See my comment above…am proposing a hybrid solution…UBI +JGR, a Job Guarantee ‘Rebate’ reclaimable as a tax deduction for any organisation that permanently employs someone on a full/part time basis. That way Job Guarantee work grows organically, and is channelling the pirate spirit of NABBB (not another bloody big bureaucracy)!

The basic income amount in our policy is at least two years out of date, because I have failed to update it. So the 14K should come with a pinch of salt and a promise (on my part) to correct it this year.

The chief benefit of the job guarantee is that it offsets the worst side effects of the NAIRU. The NAIRU (non-accelerating rate of unemployment) is a concept used in monetary policy, and essentially says interest rates should be used to ensure that full employment can never be reached. If the unemployment rate gets too low, interest rates get cranked up in order to slow the economy down. This is how monetary policy works today. Keeping a so-called “buffer stock” of people perpetually unemployed means that wages can be kept down for everyone else. It is a calculated intervention in the economy by the authorities to rig the game against wage labour. And it mostly goes on unnoticed.

Many countries who brought in NAIRU also brought in offsetting measures such as more income redistribution and universal healthcare, but it’s never really been enough. And there has been a lot of welching on the social compact, with the social wage being eroded and governments actually abusing/targeting the very people they have forced to be unemployed, purely because they are where government policy has put them.

So there is a strong moral argument for a job guarantee to offset the impact of forced unemployment. But there are also many practical issues on the implementation side and several ways in which a job guarantee could be done. The ideal policy in my view would be to propose a trial of several different job guarantee approaches in different disadvantaged communities, with intent to collect data and allow the most successful models to spread and be adopted elsewhere. An evidence based party has to be guided by evidence. Full rollout of the idea would be an end outcome if the concept works in practice, isn’t rorted and doesn’t become a vehicle for bullshit jobs.

You could also go even more radical. Abolish NAIRU altogether and if inflation threatens, increase interest rates or levies on land only, and then allow land sales to the state at a fixed price. In effect, contain inflation by the suppression of land prices rather than wages. This is another thing that might not work in practice, but might nonetheless be worth testing. We aren’t living in stable times, which means we get to think a little bigger about what is or isn’t possible.

Agreed. Piloting different approaches before roll out makes sense, it’s just basic good public policy practice.

Agreed, but I say why not do both? Since a Job Guarantee replaces the NAIRU buffer stock of unemployed/underemployed with the NAIBER (Non-Accelerating Inflation Buffer Employment Ratio) of JG employed, we can combined this with policies targeted against asset price inflation in land and other monopoly property rights to reduce the NAIBER ratio even further. This will take pressure off the Job Guarantee and make it easier to operate, given there would be less reliance on it.

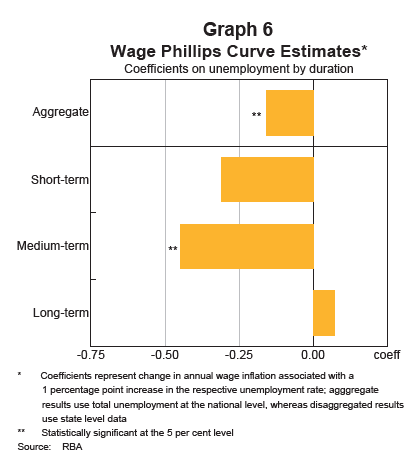

Additionally I have forgotten to mention the JG is a more effective tool for keeping wage demands suppressed than the NAIRU.

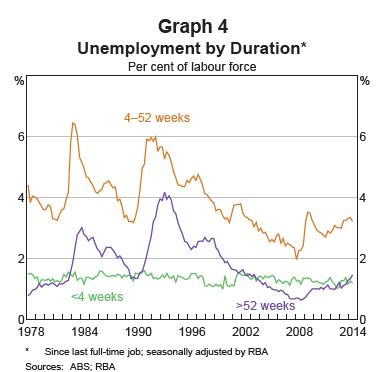

Under NAIRU conditions, over time those locked out of the labour market lose their skills and become ineffective at suppressing inflation.

Whereas under a NAIBER system workers are publicly employed, undergoing continuous on the job training and thus far more job ready. This means these workers present a credible threat to employees in the private sector. Should workers attempt to bargain too hard for wage increases, employers can simply turn to a pool of JG workers who are employable. Should inflation be pressing, governments can implement contractionary fiscal policy and workers will naturally start entering the JG pool. As the pool grows its deterrent against wage price inflation strengthens as more workers present an increasing threat to those in private sector employment.

Under a NAIBER system we would likely see unemployment fall <2% to roughly the <4 weeks unemployed line, given this is a good proxy for frictional unemployment. Underemployment would be eliminated, and discouraged workers would rejoin the labour force, boosting the participation rate.

Casualisation would also reverse to some extent (especially in the lowest paid sectors) as workers demand more permanent placements and contracts in order for employers to retain them, else they may walk away to the JG.